As part of any Group Benefits plan, we know that insurance is essential, but do businesses really need to insure their employees' health and dental expenses?

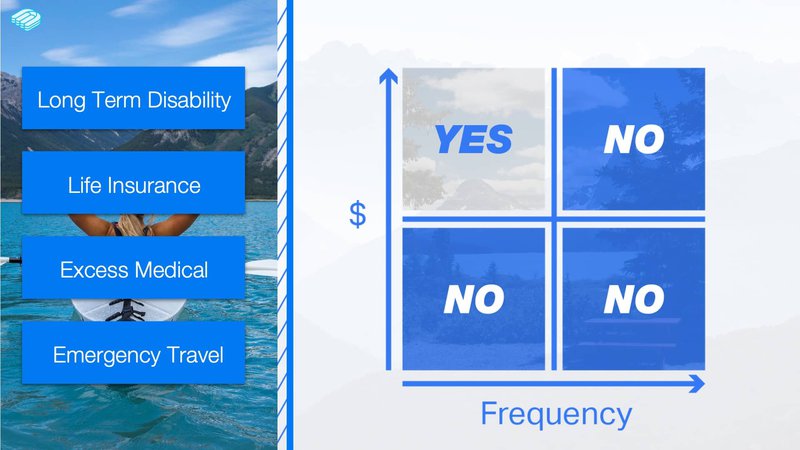

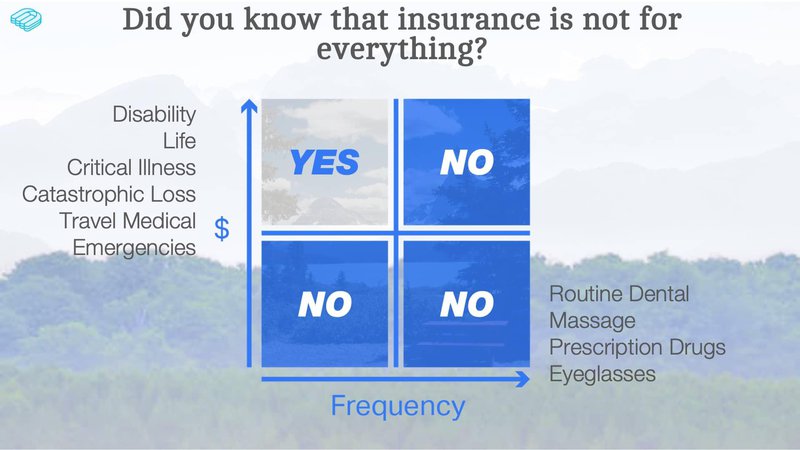

Insurance is designed to cover extraordinarily high-cost events that hopefully never happen.

The kind of events that are sudden, unforeseen, and unexpected. The outcomes are usually catastrophic and expensive.

Some notable examples of where insurance makes sense are for things like:

- An unexpected death.

- Not being able to work for an extended period because of an illness or injury.

- Having to go to the hospital while travelling.

If any of the foregoing happens, we think you'll agree that most would want the added comfort of having insurance in place.

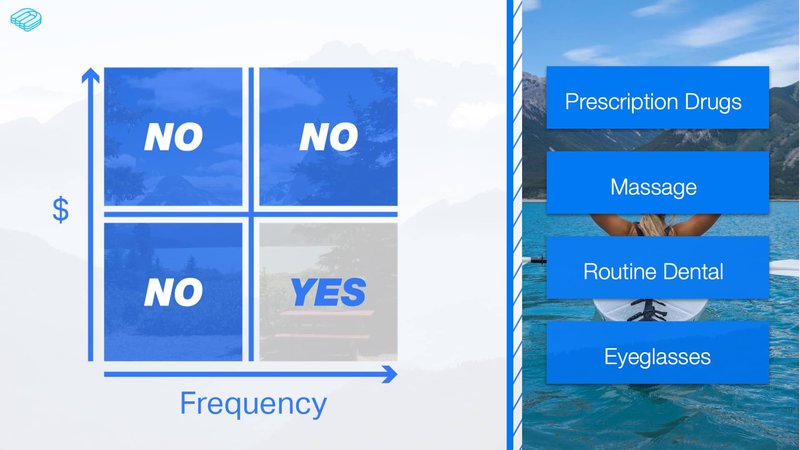

But what about regular everyday expenses? You know, the routine stuff that your employees need, like:

- Regular dental checkups.

- Massages.

- Eyeglasses.

- Routine prescription drugs.

Are these extraordinarily high-cost events sudden, unforeseen, and unexpected?

Absolutely not!

These things come up all the time and they're not extraordinarily high-cost events compared to those other examples.

They are the exact opposite of the type of expenses that should be insured.

The health and dental part of a benefits plan is typically the highest cost of the plan; it's the most used part of a benefit plan, and do you know what else?

If insured health and dental are included in a Group Benefits plan, the renewal cost will likely go up because insurance companies increase their premiums based on usage.

Pooled insurance, like Life and LTD, is risk-based. That risk and cost recovery is spread across huge numbers of premium-paying insured people so typically, a single claim in a group won't dramatically affect rates for a group.

Transactional health benefits are not pooled. Claim costs are recovered through Health Insurance Premiums from the specific group. That's why, over a couple of years, it's a sure bet there will be a significant increase on renewal.

Here's where we can help.

We'll provide you insurance where it's needed and set up a better plan for all your health and dental needs that will deliver all the benefits you could want in the most efficient way possible while keeping you in control of the costs.